Unclaimed lifafa isn’t “lost money”—it’s a time-bound, condition-based digital reward. Understanding UPI app design reveals why most expire, and when action truly matters.

If you’ve gotten a “You have an unclaimed lifafa” alert, panic often kicks in. Many assume money landed then vanished.

The truth is simpler: In most cases, the reward never got credited until you claim it.

This article breaks down lifafa mechanics, why expiry is by design, and tips to sidestep confusion.

Table of Contents

Key Takeaways

- Unclaimed lifafa isn’t deducted from your bank.

- It only becomes money after you claim it.

- Expiry is intentional, not a glitch.

- Most expired lifafas can’t be recovered.

- Some alerts are scams—verify in-app.

- Know the system to avoid chasing ghosts.

Who This Article Is For

Ideal readers:

- Confused UPI users in India seeing lifafa alerts.

- Beginners thinking money vanished.

- Intermediates seeking expiry and recovery facts.

Not for:

- Those hunting hacks or loopholes.

- Users expecting lifafa to act like bank transfers.

What Is an Unclaimed Lifafa?

A lifafa is a conditional digital incentive, not wallet cash. It could be cashback, promo rewards, or engagement bonuses—but never incoming UPI transfers or refunds.

Until you tap “Claim,” no usable money exists.

Typical Value Range (Important)

Lifafas are low-value promos (e.g., ₹10–100) meant to boost engagement, not replace income. That’s why expiry rules bite hard and recovery is rare.

India-Specific Context

Lifafas thrive in UPI (governed by NPCI, aligned with RBI clarity rules). Similar rewards exist globally, but the term and flow are UPI-unique.

How Lifafa Gets Created

Backend triggers include:

- Minimum transaction amount.

- Eligible merchant/campaign.

- Time-bound rules.

Apps skip auto-crediting for:

- Cost control (not all rewards redeem).

- Fraud prevention (manual claim curbs abuse).

- Engagement (gets you opening the app).

This holds across PhonePe, Google Pay, Paytm, and others.

Why Lifafas Go Unclaimed (Top Reasons)

| Reason | What Happens | Fixable? |

| Missed notification | No claim action | Before expiry |

| App not opened in time | Silent expiry | No |

| Misread eligibility | Invalid reward | Rarely |

| Assumed auto-credit | No money ever created | No |

User behavior + smart design = most unclaimed cases, not app bugs.

User Sentiment Snapshot (from reviews/forums):

- Confusion > cheating claims.

- Frustration ties to expiry myths.

- Rare actual losses; mostly expectation gaps.

Expiry Rules: Is the Money Gone?

No funds get yanked—your bank stays untouched. Expiry just ends the promo window; the reward never materialized.

Strict rules stem from budgeted campaigns with fixed lifespans. Support can’t override.

Can You Recover It?

| Timing | Outcome |

| Before expiry | Usually claimable |

| After expiry | Almost never recoverable |

Example: 24-hour lifafa + opening app at 26 hours = zero money created.

Spot Real vs. Fake Lifafas

| Indicator | Genuine | Scam |

| Location | Inside official app | SMS/WhatsApp |

| Links | None external | Shady URLs |

| OTP Ask | Never | Often |

| Wording | “Claim reward” | “Pending money—act now” |

Rule: Verify only in-app.

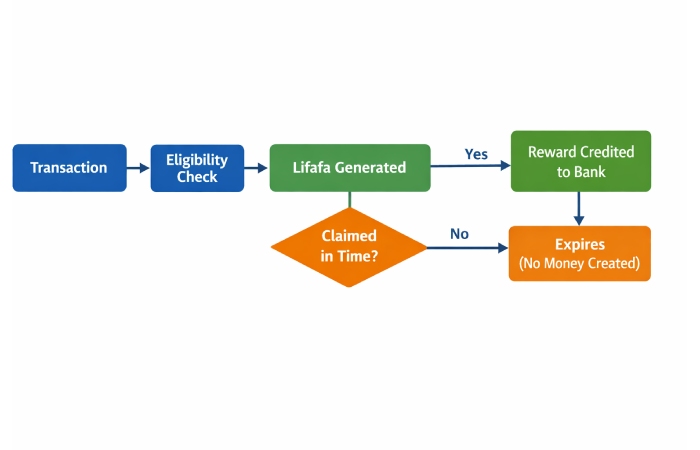

Lifafa Lifecycle Diagram

Avoid Unclaimed Lifafas Next Time

- Treat as coupons, not guaranteed cash.

- Check rewards post-transaction.

- Limit notifications to essentials.

- Skip auto-credit assumptions.

UPI-Wide Patterns

| Pattern | App Goal | User Effect |

| Manual claim | Budget/fraud control | Requires your action |

| Short expiry | Pace campaigns | Delay = no reward |

| Conditions | Fair use | Not every tx qualifies |

Common Myths Busted

- Lifafa ≠ real money pre-claim.

- Expiry ≠ glitch.

- Support ≠ magic override.

Wrapping Up

Unclaimed lifafa means a missed promo, not lost funds. Grasp the system, and alerts lose their sting—trust in UPI grows.

Also Read: File Transfer Protocol (FTP): Where It Still Fits And Where It Fails