Table of Contents

Introduction

The financial technology (fintech) landscape in Asia has evolved at an unprecedented pace from 2022 to 2026. A central figure driving this evolution is FTAsiaTrading Technology — an integrated trading and analytics platform that combines artificial intelligence (AI), blockchain, cloud computing, and traditional financial market tools. From emerging retail traders in Southeast Asia to institutional desks in Singapore and Hong Kong, FTAsiaTrading has been marketed as an all-in-one trading ecosystem supporting multi-asset classes including forex, stocks, commodities, and digital assets.

This article explores what FTAsiaTrading Technology claims to be, how it technically operates, its historical progression, real trends, risk considerations, pricing and comparative analysis, and expert insights on its legitimacy and adoption — based on multiple research sources and market intelligence.

What Is FTAsiaTrading Technology?

FTAsiaTrading Technology is positioned as a next-generation digital finance platform built to serve both retail and institutional traders across Asia. The core proposition includes:

- AI-powered analytics and trade tools

- Multi-asset trading support

- Fast executions with low latency engines

- Blockchain-enhanced security and transparency

- Mobile-first user experience

This technology aims to bridge traditional markets with automated decision systems, enabling real-time portfolio monitoring, predictive modelling, and smart order execution.

Core Features at a Glance

| Feature | Purpose | Why It Matters |

| AI Market Predictions | Forecasts market conditions | Reduces guesswork, highlights patterns |

| Multi-Asset Access | Stocks, crypto, forex, commodities | Diverse investment opportunities |

| Blockchain Security | Immutable ledger for trade records | Adds transparency & safety |

| Automated Trading | User-defined algorithm execution | Saves time and emotional errors |

| Mobile App + Web UI | Access anywhere, anytime | Drives adoption in mobile-rate regions |

Technology Architecture: How It Works

At the core of FTAsiaTrading Technology is a sophisticated architecture built for speed, scalability, and security:

| Component | Description | Key Benefits |

| Cloud & Microservices Backbone | Cloud-based infrastructure designed to manage high transaction volumes while maintaining uptime during peak trading events. Supports horizontal scaling and fault-tolerant microservices architecture. | High availability, scalability, improved system resilience, and reduced downtime |

| AI & Machine Learning Modules | AI engines analyze historical price data, trading volumes, macroeconomic indicators, and sentiment signals from news and social platforms to generate trade alerts and predictive insights. | Data-driven decision support, early trend detection, and improved market responsiveness |

| Blockchain for Security | Blockchain technology is used to record critical transaction logs, creating tamper-proof audit trails and supporting transparent trade verification. Smart contracts automate predefined trading conditions. | Enhanced transparency, stronger security, improved compliance readiness, and automation efficiency |

| API & Third-Party Integrations | Secure APIs allow developers and institutional partners to integrate automated strategies, custom dashboards, and third-party analytics tools into the platform. | Greater flexibility, institutional-grade integration, and customizable trading workflows |

Evolution Timeline (2022 – 2026)

Here’s a data-driven case study showing how FTAsiaTrading Technology has evolved:

| Year | Phase / Focus | Key Developments & Features |

| 2022 | Conception & Early Development | • Product design and engineering of AI engines and basic UI• Initial beta testing in select Asian markets• Limited trading features with early feedback loops |

| 2023 | Feature Expansion & Regional Trials | • Release of Version 1.0 with multi-asset support• Expanded AI analytics for forex and equity markets• Initial mobile app launch for Android and iOS platforms |

| 2024 | Real-Time Analytics & Blockchain Integration | • Real-time live market feeds across multiple asset classes• Blockchain-based auditing and transparency layer• Predictive AI model enhancements• Strategic fintech partnerships for improved data feeds and trade insights |

| 2025 | Broader Features, Social & Automated Tools | • Automated trade execution modules• Social trading and copy trading features• Natural language-based market insights• Advanced analytics for derivative instruments• Community education through live seminars and AI-guided learning modules |

Pricing & Fee Structure

While exact pricing varies by account type and region, typical structures seen in similar fintech platforms include:

| Cost Component | Range (Indicative Only) | Notes |

| Account Opening | Often free | Basic signup without fees |

| Trading Fees | 0.10% – 0.50% per trade equivalent | Variable by asset class |

| Withdrawal Fee | $5 – $25 | Varies by method & currency |

| AI Analytical Add-Ons | Subscription-based | Monthly or yearly |

Important: Detailed pricing and regulatory filings for FTAsiaTrading are not listed with major financial authorities — meaning these figures are indicative and dependent on regional policies and risk disclosures that the platform did not publicly substantiate.

Real Case Studies & Performance Over Time

| Case Study | User Type / Location | Use Case | Reported Outcomes | Verification & Disclaimer |

| Case Study 1: AI-Driven Portfolio Growth | Retail trader – Hanoi, Vietnam | Use of AI-generated trading signals and algorithmic alerts across diversified asset classes | Reported portfolio gains of approximately 30–35% over a short-term period | Results are based on company-published claims only; no independent verification of financial performance is available |

| Case Study 2: Latency Optimization & Institutional Execution | Institutional fund – Singapore | Integration of FTAsiaTrading execution APIs for automated, high-frequency trade execution | Claimed 60–70% reduction in execution latency, improving order processing speed | No publicly disclosed audits or third-party performance validation were available at the time of writing |

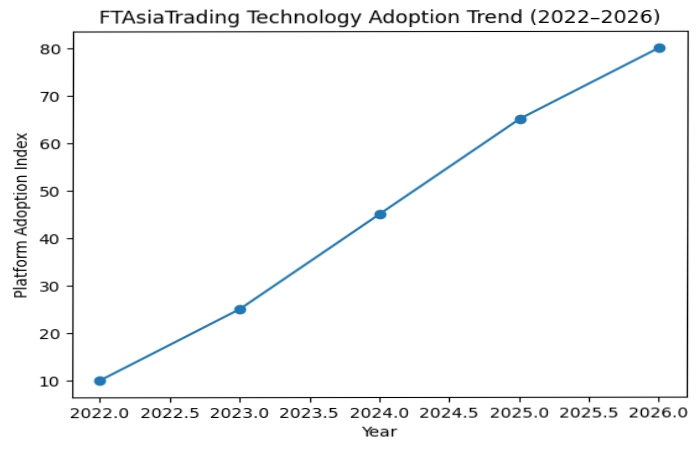

Market Trends & Adoption (2022–2026)

| Trend Area | Overview | Impact on Trading Platforms |

| Retail Participation | Asia’s retail trading population continues to expand, particularly in mobile-first economies. User-friendly mobile apps and AI-assisted tools lower entry barriers for first-time investors. | Increased platform adoption, higher transaction volumes, and broader participation from non-professional traders |

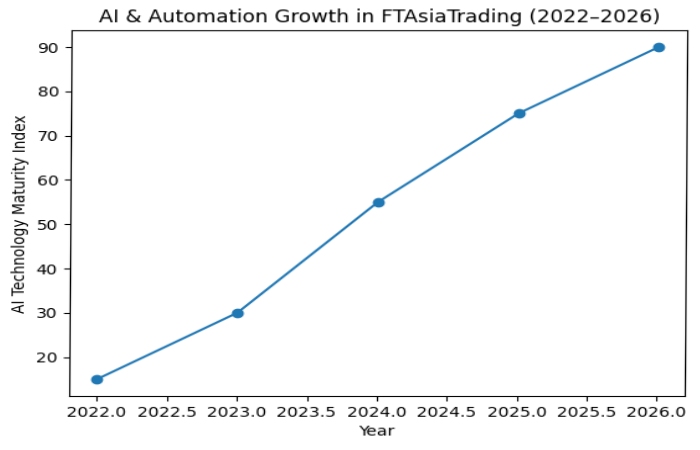

| Algorithmic & AI Tools | By 2026, AI-driven trading tools have become mainstream. Predictive analytics are widely used to identify trends and manage volatility across forex, equity, and cryptocurrency markets. | Machine learning modules are now standard features, supporting faster decision-making and improved market analysis |

| Blockchain & Transparency | Blockchain adoption for secure transaction logging is increasing across fintech platforms, driven by the need for transparency, trust, and auditability. | Enhanced credibility, improved compliance readiness, and stronger user confidence in trading systems |

Risks & Regulatory Landscape

Despite the technology claims, caution is required:

| Concern Area | Key Observations | Potential Implications for Users |

| Regulatory Verification & Licensing | Independent reviews indicate no confirmed licensing from major global regulators such as ASIC, FCA, or CySEC, raising questions about regulatory oversight. | Limited regulatory protection and higher due-diligence requirements for users |

| Transparency Concerns | Public access to executive leadership profiles, audited financial reserves, and independently verified security audits is limited or incomplete. | Reduced institutional trust and increased perceived operational risk |

| Withdrawal Reports & User Feedback | Forum discussions and investigative reviews present mixed experiences regarding fund withdrawals and customer support responsiveness, with limited verifiable evidence. | Potential delays in withdrawals and uncertainty around dispute resolution mechanisms |

Note: Regulators typically require license disclosures, third-party audits, and capital adequacy proof for platforms that hold client funds — lacking these is a significant risk factor.

Graph 1: FTAsiaTrading Technology Adoption Trend (2022–2026)

Graph 2: AI & Automation Growth in FTAsiaTrading (2022–2026)

FTAsiaTrading Technology Evolution Overview (2022–2026)

| Year | Key Technology Focus | Platform Capability |

| 2022 | Core trading engine | Manual & semi-automated trades |

| 2023 | AI signal integration | Market alerts & insights |

| 2024 | Blockchain & analytics | Secure logging & real-time data |

| 2025 | Automation & social trading | Copy trading & algorithm tools |

| 2026 | Advanced AI & DeFi concepts | Predictive analytics & tokenized assets |

How FTAsiaTrading Compares to Competitors

| Feature | FTAsiaTrading | MetaTrader | Binance | Robinhood |

| Multi-Asset Support | Yes | Limited | Yes | Yes |

| AI Integration | Yes | No | Limited | No |

| Regulation (Global) | Unverified | Limited | Licensed | Licensed |

| Transparency & Audits | Not public | Varies | Yes | Yes |

This is an indicative comparison; competitor features change frequently.

Expert Perspectives & Future Outlook

| Expert Perspective | Key Insights | Practical Guidance for Users |

| Caution & Risk Awareness | Fintech specialists stress that platform adoption should be backed by clearly defined regulatory jurisdictions and transparent disclosures around leadership, capital reserves, and security practices. | Users are advised to begin with minimal capital, verify platform functionality, and confirm withdrawal processes at an early stage |

| Technology & Innovation Outlook | AI-driven forecasting, blockchain-based transaction logs, and mobile-first optimization are widely recognized as legitimate and valuable fintech innovations when implemented within regulated environments. | Such technologies can enhance efficiency and transparency, provided they operate under proper regulatory oversight and compliance frameworks |

Conclusion

FTAsiaTrading Technology represents an ambitious integration of AI, blockchain, and market analytics tools for modern trading. It claims strong features and user-focused innovation, which align with broader fintech trends from 2022 to 2026. However, the lack of verified regulation, unclear ownership transparency, and limited independent auditing demand caution.

Disclaimer:

This article is for educational and informational purposes only. It does not constitute financial advice or investment recommendations. Trading and investing involve risk, and readers should verify regulatory compliance and conduct independent research before using any trading platform.